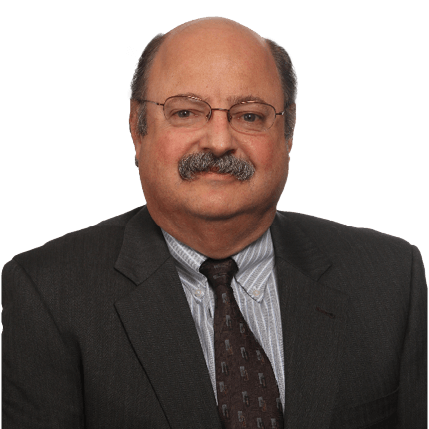

KRCL has represented banks and financial services companies since its inception.

Our clients include all types and sizes of financial institutions, including international, national, and regional banks, state-chartered banks, private equity groups, hedge funds, multi-state holding companies, trust companies, community banks, mortgage banks, and related entities.

The Firm has first-hand knowledge of our clients' industry, as well as what drives their businesses. More than half of the Firm's lawyers represent financial institutions and related entities. With that depth, the Firm's Financial Services Practice Group provides representation across the spectrum of issues that affect the financial services industry:

Transactional

KRCL handles a variety of regulatory, lending and other transactions that affect companies involved in financial services. We routinely negotiate, document, and close myriad transactions for our clients.

Specific areas of concentration include:

- Aircraft Financing

- Asset-Based Lending

- Asset Securitization

- Bank Operations

- Branch Banking

- Capital Markets

- Compliance and Disclosure

- Consumer Finance

- Credit Enhancements

- Cross-Border Financial Transactions

- Derivatives

- De Novo Financial Institution Charters

- Energy Financing

- Export Credit Insurance-Backed Lending

- Export/Import Lending

- EX/IM Bank Guaranteed Lending

- Foreign Receivables-Backed Lending

- Global Trade Transactions

- Interest-Rate Swaps

|

- Interim and Permanent Construction Financing

- Lending Limit Advice

- Litigation

- Letters of Credit

- Loan Portfolio Acquisition

- Loan Restructuring

- Mergers and Acquisitions

- Mezzanine and Subordinated Financing

- Multi-Currency Facilities

- OREO Disposition

- Real Estate Lending

- Real Estate Site Acquisition

- Regulatory Compliance

- Regulatory Enforcement Defense

- SBA Export Lending

- Syndicated Lending

- Synthetic and Other Leveraged Leasing

- Working Capital and Term Facilities

|

Litigation

Litigation, real or threatened, poses significant risks to lenders, including the five primary risks identified by the Office of the Comptroller of the Currency: liquidity risk, reputation risk, strategic risk, credit risk and compliance risk.

Whether the issues presented by these risks give rise to unenforceable contracts, lawsuits, adverse judgments, lost business opportunities, loss of corporate focus or diminished reputation in the community, KRCL understands these risks and also understands the need to manage the risks.

KRCL's Financial Services Practice Group provides comprehensive litigation and dispute services to banks and other financial services companies. We routinely assist clients in a variety of matters, including general operations, material defensive litigation, and credit risk management. Some specific areas are mentioned below:

- Defensive litigation, including securities fraud, fiduciary duties, mortgage lending practices, and consumer class actions.

- Employment litigation, including securities-related arbitrations, defense of EEOC related inquiries, enforcement and defense of non-competition provisions and defense of any employment discrimination litigation matters.

- General bank operations, with emphasis on claims under Articles 3 (negotiable instruments), 4 (deposits and collections), and 4A (funds transfers) of the Uniform Commercial Code.

- Lender liability defense, including claims arising from non-disbursement of loan funds, termination of credit facilities, charging default rates, legality of fees and charges, refusing to extend loans, purported oral loan commitments, and rejecting loan payments after default.

- Statutory and regulatory compliance litigation, including the anti-tying provisions of the Bank Holding Company Act, the Equal Credit Opportunity Act, the Truth in Lending Act and Regulation Z, usury under the National Bank Act and State laws, the Real Estate Settlement Procedures Act, and CERCLA.

- Inter-bank liability, including the resolution of disputes between agents, participants, and syndicate members.

Insolvency and Creditor Rights

KRCL devotes a substantial practice to regional and national clients involved in every aspect of insolvency. With a proven track record, KRCL is often called upon to appear for our clients in numerous high-stakes workout, restructuring and bankruptcy matters. Our attorneys creatively solve legal problems on behalf of clients. Our bench is broad and deep. With a solid understanding of what it takes to effectively resolve troubled debtor-creditor relationships, KRCL will find a way to achieve client goals.

Our experience includes:

- Asset sales

- Automatic stay relief

- Avoidance actions

- Cash collateral

- Confirmation litigation

- Debt restructuring

- Foreclosures

|

|